The Goucher College Endowment

The Goucher College endowment is a collection of funds and other assets given by philanthropically minded members of the community to support the college’s mission, now and for all future generations of students.

Composed of many individual funds that are pooled and invested together, the endowment

is designed to grow over time, providing a steady source of support for Goucher now

and into the future.

Some gifts to the college can be used in full immediately, like those to the Greater

Goucher Fund (GGF), which addresses operations and areas of greatest need across the

college. The purpose of the Goucher endowment, however, is to support the fiscal sustainability

and stability of the college over decades. Endowment gifts are invested, and donors

may specify the purpose per a written agreement with Goucher for which the income

from the investments must be used.

The endowment’s principal—that is, the invested funds—is not spent by the college.

However, each year, the college uses income made from the endowment’s investments

to support Goucher’s academic mission. Goucher’s endowment is important because it

allows the college to continue to earn income over a long period of time, which supports

the college’s operating needs while preserving capital for the benefit of future generations.

Goucher College Endowment Investment Guidelines

The Endowment provides a sustainable and reliable level of support to the college's operations over time. The following long-term financial objectives apply to the Endowment as a whole:

- Support the operations and strategic initiatives of Goucher College.

- Preserve the Endowment's value and purchasing power to the greatest extent possible while providing such support.

- Seek capital growth to increase Endowment value and purchasing power.

- Diversify the Endowment assets, as prudent given the size of the assets, to reduce

the volatility of returns.

Facts About the Endowment

- The value of the Goucher College endowment as of June 30, 2024 is $293 million.

- Goucher College is in the top 15% of endowment rankings for all private colleges and

universities (source: IPEDS data).

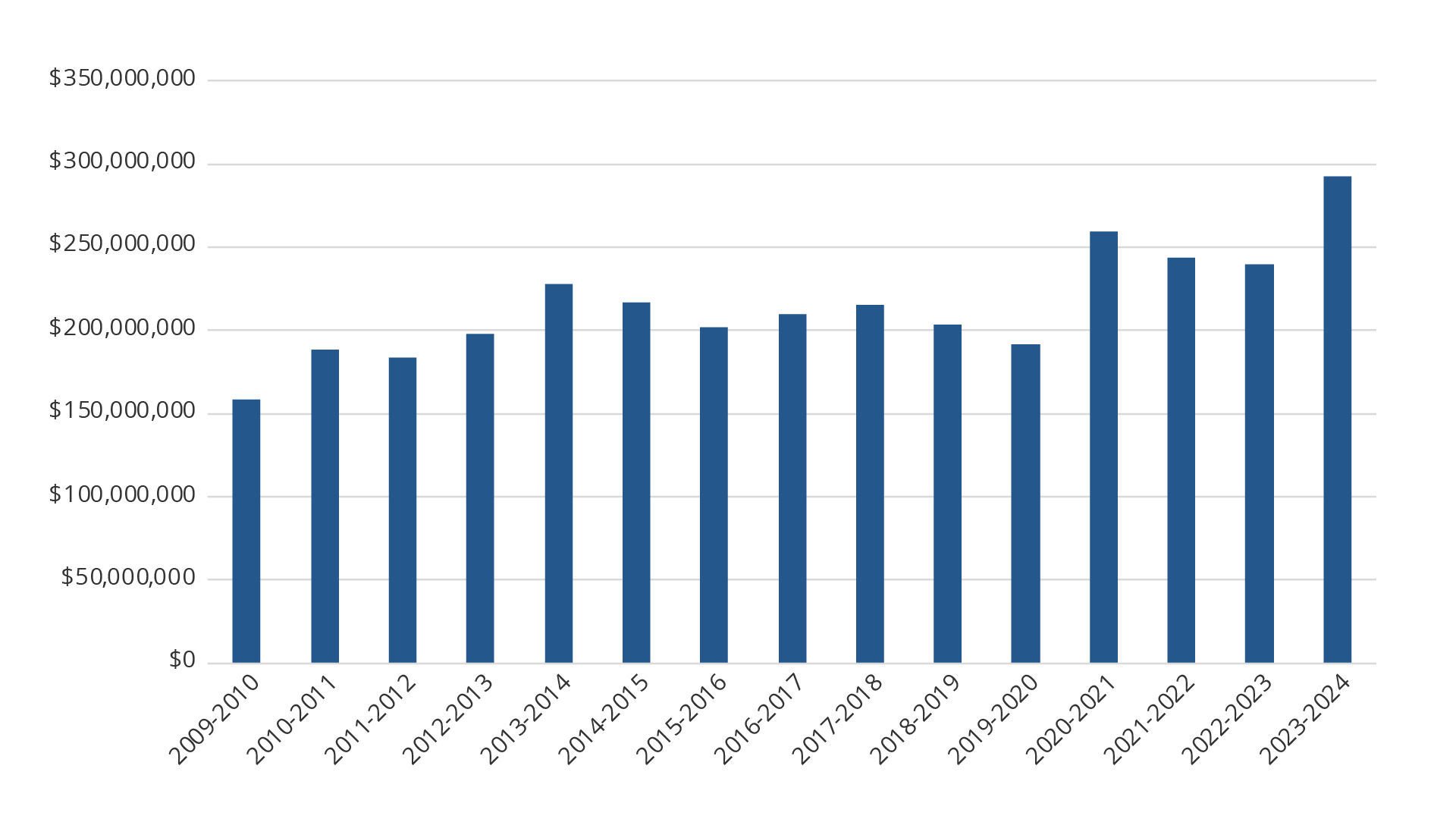

Goucher College Endowment Growth over Time

The Goucher College endowment growth annually (source: audited financial statements, endowment footnote).

2009-10 — $158,375,000

2010-11 — $188,336,000

2011-12 — $183,717,000

2012-13 — $197,497,000

2013-14 — $227,559,000

2014-15 — $216,707,000

2015-16 — $201,482,000

2016-17 — $209,577,000

2017-18 — $214,921,000

2018-19 — $203,430,000

2019-20 — $191,378,000

2020-21 — $259,341,000

2021-22 — $243,311,000

2022-23 — $239,770,000

2023-24 — $292,650,000

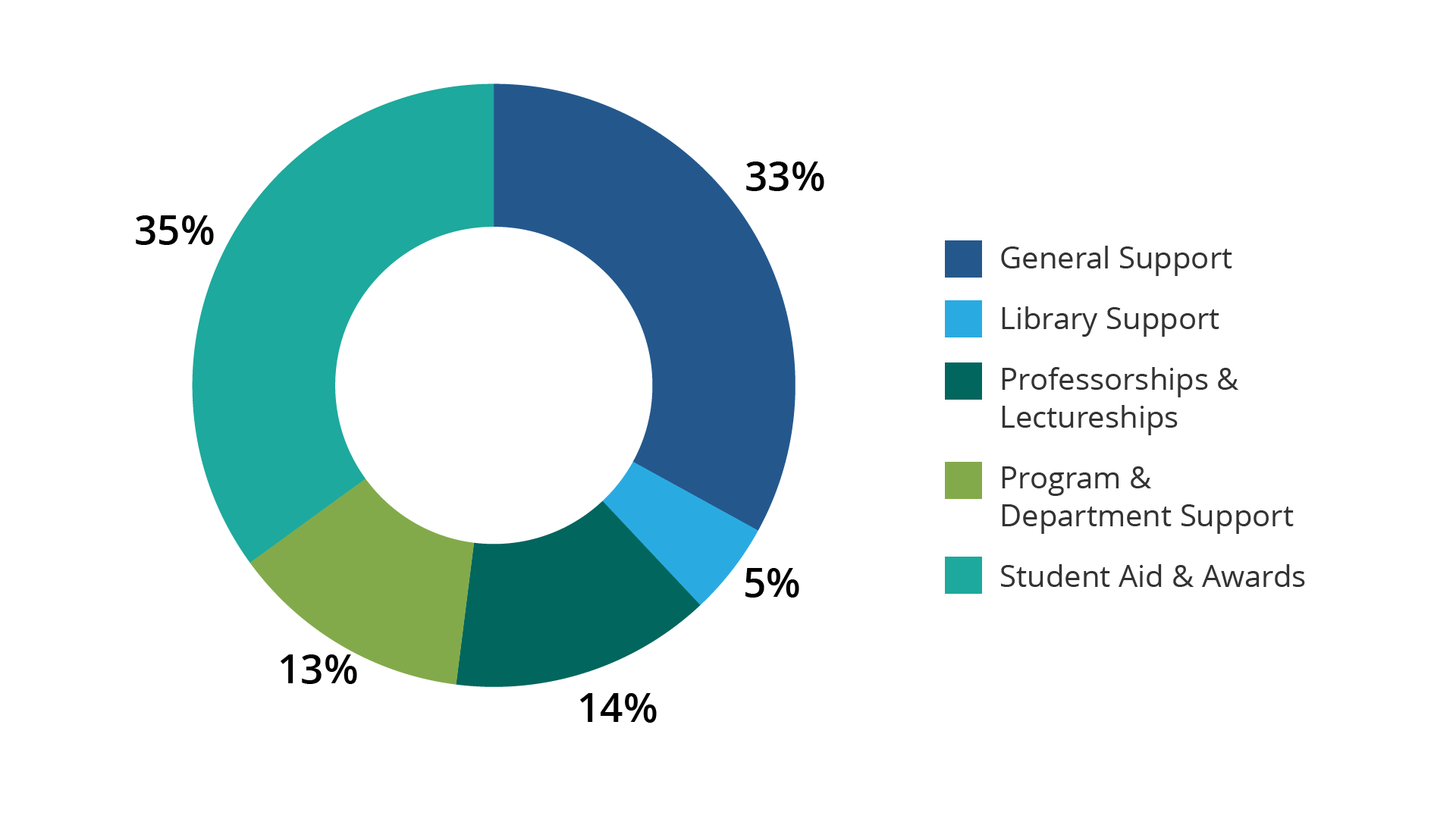

How the Goucher College Endowment is Allocated

The Goucher College endowment is allocated as:

- 33% General Support

- 5% Library Support

- 14% Professorships and Lectureships

- 13% Program and Department Support

- 35% Student Aid and Awards

Goucher College Endowment Management

The Goucher College Board of Trustees has appointed an Investment Committee to oversee the endowment, and the Committee has engaged external investment consultants and managers to invest the funds. The Committee and its consultants and managers follow all state and federal laws, regulations, rulings, and the duty of loyalty imposed by law. They also manage and invest the endowment prudently and in good faith. The Investment Committee, consultants, and managers consider the charitable purposes of the college and the general purposes of the endowment when administering and investing the institutional assets.

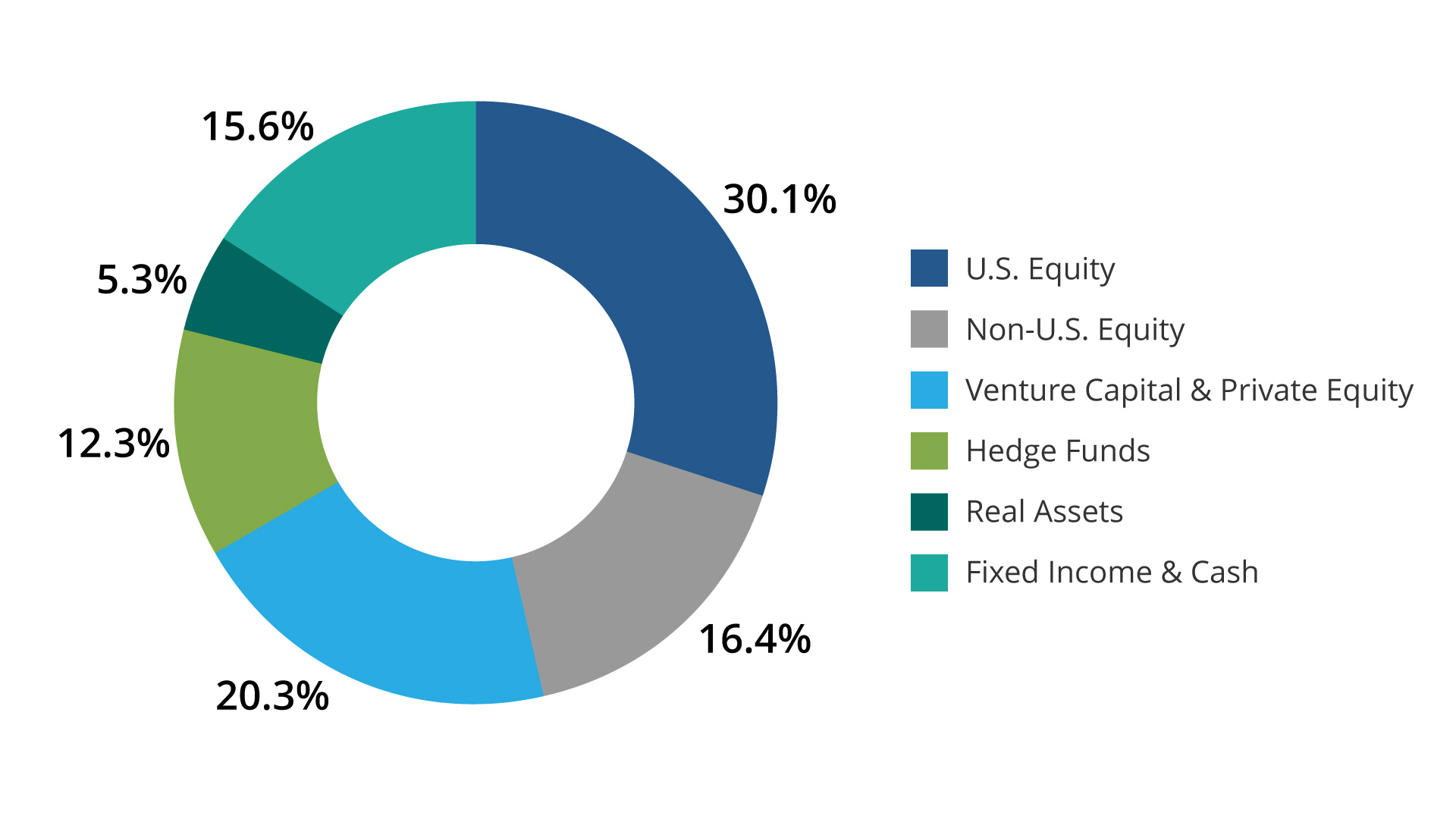

Where the Goucher College Endowment is Invested

Asset allocation is based on a strategic target asset mix established by the Investment Committee for the major asset classes. The target asset allocation reflects the financial objectives established in the Investment Policy Statement, including long-term return objectives and risk tolerance. Endowment assets are adequately diversified by asset class to stabilize total Endowment results over short-term periods.

The Goucher College investments are allocated as:

- 30.1% U.S. Equity

- 16.4% Non-U.S. Equity

- 20.3% Venture Capital & Private Equity

- 12.3% Hedge Funds

- 5.3% Real Assets

- 15.6% Fixed Income & Cash

Frequently Asked Questions

How is the endowment different from Goucher's annual operating budget?

The annual operating budget is the board-approved financial plan that projects the college’s expected revenue and expenses for the fiscal year. The endowment represents assets that were historically donated to the college to provide ongoing financial support. The assets are invested in perpetuity, but the return or income generated by the investments may be spent to support the purposes outlined by the donor. Every year, the board appropriates the portion of earnings that may be spent in compliance with the purposes outlined by the original donor. This is called the endowment payout, which appears as a revenue line on the college’s annual operating budget.

How does the endowment support Goucher's annual operating budget?

The annual payout from the endowment earnings is one of the revenue streams that funds annual operating expenses.

How much does the revenue generated by the endowment assets contribute to the annual operating budget of the college?

On any given year, the endowment contributes 15% to 18% of the college's operating budget and helps to underwrite scholarships, financial aid, and faculty and staff salaries.

How are endowment funds used?

Donors may restrict the purpose of their gifts to the endowment. Restricted gifts are used exclusively for one defined purpose. For example, the income from a restricted endowment for a scholarship is used exclusively to fund that scholarship. Other endowments are for the college's general purposes. These unrestricted endowment gifts increase the endowment's principal, and the annual payout and income may be used for a variety of institutional needs.

What is the principal of an endowed fund?

The principal of an endowed fund is the amount of money that is maintained and managed in perpetuity to generate earnings that support Goucher priorities. The principal may appreciate over time and generate more income to be used for the fund's purpose. For example, an endowed fund that is established with a $1 million gift maintains a $1 million principal.

Does Goucher invest in specific companies either in the United States or overseas?

Goucher invests with external investment firms that invest on behalf of Goucher through commingled funds or separately managed accounts. These external firms invest directly in both domestic and foreign companies. Goucher’s portfolio is diversified across geographies, sectors, and strategies.

Can Goucher spend the endowment principal in an emergency?

Unlike a bank account whose funds can be accessed and spent if funds are available, an endowment must be maintained in perpetuity. In general, the principal of an endowment cannot be legally or contractually spent.